A new roof is one of the most significant investments homeowners make in their homes. Through roof financing, homeowners can more readily address the unexpected expense a roof can bring. Contractors who can offer manageable monthly payments and help homeowners navigate the roof financing process are providing an invaluable service to their clients, and can become a trusted partner for years to come.

We spoke with Mary Mokris, Consumer Finance and Payments Manager at GAF to find out:

The common ways homeowners pay for a roof; including cash, credit cards, HELOCs, personal loans, and installment loans.

Why roofing payment plans reduce homeowner stress and can help contractors close more, and higher-value, jobs.

How contractors who offer roof financing and explain payment options clearly build trust and can win more business.

Here's what you need to know about roof financing and how you can start offering it to your clients.

How Homeowners Pay for Roofs

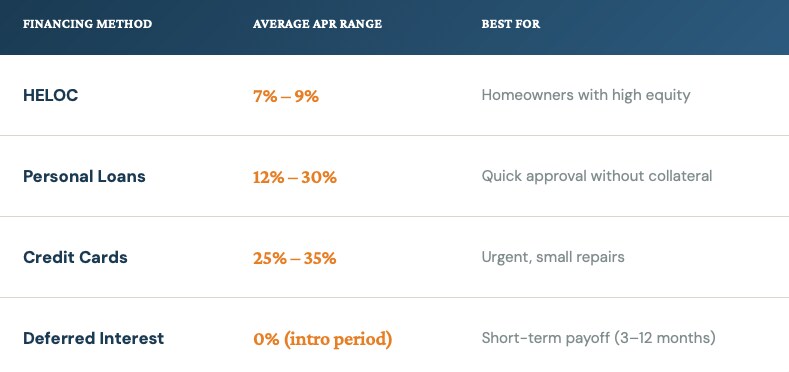

The common ways to pay for a roof include cash, credit cards, HELOCs, personal loans, deferred-interest plans, and installment payment approaches. Understanding these options helps roofing contractors confidently explain roofing payment plans to homeowners.

Paying for a Roof with Cash

Upfront cash payments are often how most homeowners pay for a roof when they've planned for it in advance or have savings in the bank to cover a roofing emergency.

Paying for a Roof with Credit Cards

When a roofing situation requires immediate urgency, credit cards might be a strong consideration for homeowners who receive rewards with their credit cards and who are comfortable with the debt they can pay off each month. However, the high interest rates from credit cards can add up making the price of a roof much larger than its initial cash ticket price.

Financing via Traditional Loans and HELOCs

Traditional loans, like a Home Equity Line of Credit (HELOC), can help homeowners pay off a home renovation without the high interest that credit cards bring by using their home as collateral. However, HELOCs can sometimes take weeks to be approved. Personal loans are also an option but may have higher interest rates than a typical HELOC.

Deferred/Same-as-Cash Options

Deferred or same-as-cash financing options offer a special promotion of a 0 % introductory Annual Percentage Rate (APR) period. As long as the homeowner pays it all before the period ends, they won't pay any interest. These credit card and loan offers can last from 3 months, up to a full year and are offered by different financial institutions.

Hybrid Approaches

It's not uncommon for homeowners to pay using multiple methods, especially when insurance claims are involved. Oftentimes homeowners can be left waiting to start repairs while the Insurance company works through the claim process. If they use financing, they can get started on the repair/replacement right away, and pay off their loan when they receive the insurance check.

The Psychology of Roofing Purchases

While there are renovations homeowners can put off, like installing insulation or fixing small foundation cracks, it's hard to ignore a damaged roof. When the roof starts to leak, it creates a high-stress situation that most homeowners will want to address immediately. This creates urgency but also stress due to the high upfront costs that most people associate with fixing or replacing an entire roof.

Even the best-prepared homeowners will find that a sudden expense of thousands of dollars or more can be an uncomfortable situation. Breaking that expense into more manageable monthly payments can help alleviate that stress.

Contractors who can provide clarity and trust when it comes to offering homeowners roof financing options might find that because homeowners can afford more, they may have a larger job. Since homeowners are accustomed to different payment options in other parts of their lives, you can appear more professional and ease their burden by offering these different methods.

"No one expects to walk into a dealership and pay for their car by writing a check. We don't even do that with our phones anymore," says Mary Mokris, Senior Marketing Manager of Consumer Payments and Financing at GAF.

Mokris suggests that, as a contractor, you should take the cost of a loan into your margins and spread it out across how you price everything. If 30 % of your homeowners take advantage of your loan, you take that 30 % of expense and put it over 100 % of your business.

How Contractors Can Guide the Financing Conversation

When it comes to a massive expense like a roof, homeowners are looking for answers from a trusted professional. By guiding the conversation and offering payment solutions, you can gain their confidence and trust.

When you first speak to a homeowner who sounds unsure, consider mentioning the different financing options early. The more aware they are of what options they have, the more likely they are to want to fix their roof and choose you as their go-to contractor.

"If you just plant the seed that you have payment options, you can relax the entire conversation," says Mokris.

It's best to keep things as simple as possible, as finances are already a complicated subject, so you don't want clients to feel overwhelmed. Just make sure to help them realize the short-term and long-term costs by explaining how much they would pay over the term of the loan compared to if they just paid upfront with cash. Transparency is key to winning over your clients' trust.

Mokris also suggests you shouldn't just use financing as a "save strategy" when you think you may lose a sale. You can bring it up to every client, whether you think they need it or not. Some clients might not ask you about financing since they can feel embarrassed, so it's best if you bring it up early in the conversation.

"Just bring it in, and bring it in early," says Mokris. "That's the best sales practice."

GAF SmartMoney Financing Options

GAF offers a range of payment solutions, helping homeowners get badly needed roof fixes quickly and allowing contractors to provide flexibility to their clients. With GAF SmartMoney, your clients can pay you through card, check, or financing.

"GAF SmartMoney offers contractors the ability to offer their customers multiple financing options with several different types of companies," says Mokris.

It's all done paperless to keep you organized, and you can accept mobile and online payments on the field instantly. The platform allows contractors to easily see how and when they're being paid, simplifying your payment collection process. Generally, homeowners can get financing for a new roof for up to 100 000 $.

The best part for contractors is that the diversity of lenders allows you to choose the plans that best work for you and your clients.

When a customer might benefit more from a complete roof replacement than from repairing large damaged areas, they might be more willing to spend the extra money when financing options are available. This makes it a win-win for both the client and the contractor.

Current Rate Conditions

Roof rates vary widely by year, loan type, and market conditions. Therefore, the APR range can vary widely. HELOCs tend to offer the best rates, ranging from 7 % to 9 % APR, while credit cards offer the worst rates, ranging from 25 % to 35 % APR, depending on the card. Personal loans are somewhere in the middle, between 12 % to 30 %.

To learn more about how you can offer roof financing to your clients and improve your sales process to close more deals, visit GAF SmartMoney or call (866) 488-6525. The payment solution allows you to easily accept multiple forms of payment while offering your clients a professional experience.

Frequently Asked Questions

Q: Can I finance a roof with bad credit?

Some roofing financing programs offer options for homeowners with lower credit scores, though interest rates may be higher.

Q: What is the average APR for roof financing?

APR varies by loan type. HELOCs typically range from 7 %-9 %, personal loans from 12 %-30 %, and credit cards from 25 %-35 %.

Q: How can contractors offer roof financing to customers?

Contractors can partner with financing platforms like GAF SmartMoney to provide multiple roofing payment plans without managing loans themselves.

Q: Are deferred-interest roofing loans a good option?

They can be-if the homeowner pays the balance in full before the promotional period ends. Otherwise, deferred interest may apply retroactively.